top of page

Search

Congratulations!

Huge congratulations to Jump Up For Kids on receiving the Outdoor Queensland, Outdoor Therapies Award last Friday! Madeline and the team are exceptionally talented, innovative, and compassionate Occupational Therapists, and this award is a wonderful acknowledgment of their incredible work. We’re proud to work with such an inspiring team and look forward to celebrating their continued success. #BBDB #BulimbaBusinessDeevelopmentAndBookkeeping #adminassist #bookkeeping #smallb

BBDB

Nov 4, 20251 min read

4th Foodbank Announcement: Food for Kids Program

Foodbank Queensland had a busy winter, but with school holidays upon us again Foodbank Queensland’s Food for Kids Program steps in to...

BBDB

Sep 15, 20251 min read

ATO Update for Small Businesses in Construction & Property

The ATO has just released its latest focus area as part of the ‘Getting it right’ campaign — and this quarter, it’s all about the...

BBDB

Sep 1, 20251 min read

3rd Foodbank Announcement

Bulimba Business Development and Bookkeeping is proud to celebrate and support a major milestone in the fight against hunger. Foodbank...

BBDB

Jul 22, 20251 min read

🎉 Cheers to another successful financial year! 🥂

Yesterday, our amazing team came together to celebrate the end of a productive FY25. We laughed, reflected, and took time to appreciate...

BBDB

Jul 21, 20251 min read

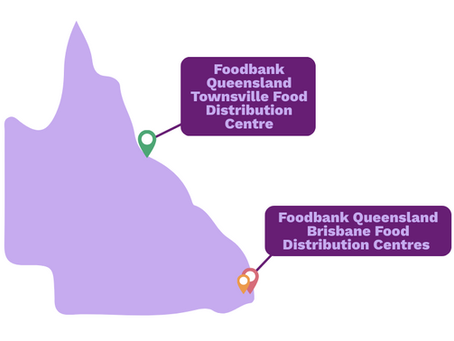

2nd Foodbank Announcement

We’ve completed our first month of donations to Foodbank Queensland and are excited to share how they’re putting our support to work in...

BBDB

Jun 17, 20251 min read

Cybersecurity Newsletter – April 2025 Edition

Stay ahead of the curve with our latest cybersecurity insights: Cyber Attacks Target Australian Super Funds Cyber Hygiene - Maintaining...

BBDB

Apr 29, 20251 min read

Queensland Small Business Month is just around the corner!

It's a fantastic opportunity for small and family-owned businesses across the state to recharge, renew, and rebuild. With over 100 events...

BBDB

Apr 28, 20251 min read

BBDB Partners with Foodbank to Fight Hunger for Children in Queensland

We’re proud to share that our team at BBDB has come together to make a meaningful commitment — partnering with Foodbank through a monthly...

BBDB

Apr 8, 20251 min read

Meet the BBDB team

The BBDB team attending their professional development at the Xero Conference last week! #tax #smallbusinesssupport #businessdevelopment...

BBDB

Sep 23, 20241 min read

Simple checks for super success

Meeting your super obligations as an employer is important, but we know there's a lot you need to think about. To help streamline the...

BBDB

Jun 20, 20242 min read

BBDB Team Christmas party

We had our BBDB Team Christmas party last night and all got to take out any pent-up angst, prior to the silly season kicking in, by...

BBDB

Nov 24, 20231 min read

Payroll check: Public holidays during paid leave

Payroll systems and software are an integral part of a business’ operations, but they’re only as good as the way they’ve been set up. ...

BBDB

Nov 14, 20231 min read

Congratulations!

We are a Finalist in the All Other Businesses Category in Di’s 2023 Bulimba Electorate Small Business Awards! we received some lovely...

BBDB

Oct 26, 20231 min read

DEANNA SUPERSTAR

We wanted to share with you all a great accomplishment by Deanna. Deanna has completed her Cert 4 in Bookkeeping in 12 months while...

BBDB

Oct 26, 20231 min read

Update your ABN details

When was the last time you checked your Australian business number (ABN) details on the Australian Business Register (ABR)? If you're not...

BBDB

Oct 20, 20231 min read

Paid family and domestic violence leave for small business

Employees of small business employers (employers with fewer than 15 employees) can now access 10 days of paid family and domestic...

BBDB

Aug 14, 20231 min read

Increase to the ATO cents per kilometre rate.

The new ATO cents per kilometre rate for 23/34 tax year is $0.85 #tax #smallbusinesssupport #businessdevelopment #bookkeeping #accounting...

BBDB

Jul 5, 20231 min read

The super guarantee rate is increasing

If your small business has employees, or hires eligible contractors, you'll need to ensure your payroll and accounting systems are...

BBDB

Jun 23, 20231 min read

Workcover Returns

Declaring the wages for your business is an important part of renewing your accident insurance policy and a key responsibility as an...

BBDB

Jun 16, 20231 min read

FIRST CONSULTATION

FREE!

We give small businesses the support they need so that business owners can get back to what they do best

bottom of page